Understanding Travel Insurance Companies: A Comprehensive Guide

Share

Traveling can be one of life’s most rewarding experiences, but it also comes with its fair share of uncertainties. From flight cancellations to medical emergencies, having the right travel insurance can provide peace of mind. In this article, we will explore the top travel insurance companies, what they offer, and why securing travel insurance is essential for any trip.

What is Travel Insurance?

Travel insurance is a type of insurance designed to cover the costs and losses associated with traveling. It can protect travelers from a variety of risks, including trip cancellations, lost luggage, medical emergencies, and more. Understanding the different types of coverage available can help you choose the right policy for your needs.

Types of Travel Insurance Coverage

- Trip Cancellation Insurance: This covers non-refundable expenses if you need to cancel your trip due to unforeseen circumstances.

- Medical Coverage: This is crucial for international travel, as it covers medical expenses incurred while abroad.

- Baggage Loss or Delay: This provides compensation for lost or delayed luggage.

- Emergency Evacuation: This covers the costs of transportation to a medical facility in case of an emergency.

- Accidental Death and Dismemberment: This offers benefits in the event of a serious accident while traveling.

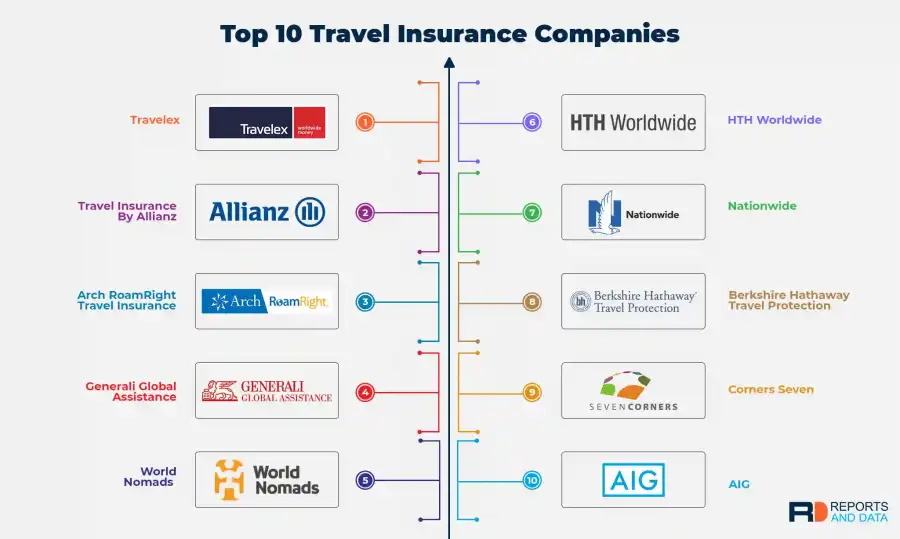

Top Travel Insurance Companies

When it comes to choosing a travel insurance provider, several companies stand out for their comprehensive coverage and customer service. Here are some of the top travel insurance companies to consider:

1. Allianz Global Assistance

Allianz is one of the largest travel insurance providers in the world. They offer a variety of plans that cater to different types of travelers, including single-trip, annual, and family plans. Their policies often include 24/7 assistance, which can be invaluable during emergencies.

2. World Nomads

World Nomads is particularly popular among adventurous travelers. They provide coverage for a wide range of activities, including extreme sports. Their policies are flexible, allowing travelers to extend their coverage while on the road.

3. Travel Guard

Travel Guard offers customizable plans that can be tailored to individual needs. They provide excellent customer service and a user-friendly claims process, making them a reliable choice for travelers.

:max_bytes(150000):strip_icc()/TRavelex-41e9ffc478cd4868808e7b0af57f0000.png)

4. Travelex Insurance Services

Travelex is known for its comprehensive coverage options and competitive pricing. They offer a variety of plans, including options for travelers with pre-existing medical conditions. Their online platform makes it easy to compare plans and purchase insurance.

5. AXA Assistance USA

AXA provides a range of travel insurance products, including single-trip and annual plans. They are known for their extensive network of medical providers and 24/7 assistance services, ensuring travelers receive help whenever they need it.

Why You Need Travel Insurance

Travel insurance is not just an added expense; it is a necessary safeguard for any traveler. Here are some compelling reasons to consider purchasing travel insurance:

1. Protection Against Unforeseen Events

Life is unpredictable, and travel is no exception. Whether it’s a sudden illness, a natural disaster, or a family emergency, travel insurance can help mitigate financial losses.

2. Medical Emergencies Abroad

Healthcare systems vary significantly from country to country. Having travel insurance ensures that you have access to medical care without incurring exorbitant costs.

3. Peace of Mind

Knowing that you are covered in case of an emergency allows you to focus on enjoying your trip. Travel insurance provides reassurance that you are prepared for the unexpected.

How to Choose the Right Travel Insurance

Selecting the right travel insurance can be daunting, but considering the following factors can simplify the process:

1. Assess Your Needs

Consider the nature of your trip, including the destination, duration, and activities planned. This will help you determine the type of coverage you need.

2. Compare Policies

Take the time to compare different insurance providers and their offerings. Look for reviews and ratings to gauge customer satisfaction.

3. Read the Fine Print

Understanding the terms and conditions of your policy is crucial. Pay attention to exclusions and limitations to avoid surprises when filing a claim.

4. Consider Your Budget

While it’s important to find a policy that meets your needs, it’s also essential to stay within your budget. Look for a balance between coverage and cost.

Booking Your Travel

Once you have secured your travel insurance, it’s time to plan the rest of your trip. Whether you’re looking for accommodations or flights, there are plenty of options available.

For a seamless booking experience, consider using the following links:

- Hotels & Flights: Book your stay and flights here

- Transfers: Arrange your transfers easily

In conclusion, travel insurance is an essential component of any trip. By understanding the various options available and choosing the right provider, you can ensure a safer and more enjoyable travel experience.